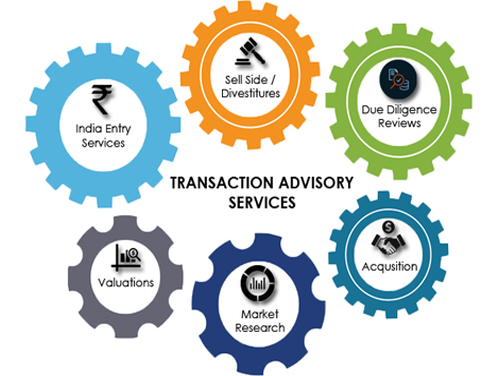

M&A Transaction Advisory

Market analysis and Valuation Considerations

Unlike public companies that have readily available market prices, private companies requires assessing various factors to estimate their worth, taking into account factors such as financial performance, growth prospects, industry dynamics, and risk factors.

M&A Broker

As an M&A broker (also known as a business broker, M&A advisor, or deal intermediary) we are professionals that facilitate the transaction, connecting buyers and sellers, facilitating negotiations, and managing the overall M&A process. Selling or buying a business can be a complex, time consuming process. We offer 100% time commitment and expertise in financing, accounting, commercial leases, contracts, managing due diligence, negotiations, preparing contracts and more.

Identifying the Right Buyer

A critical step in the process involves preparing a comprehensive target list of potential buyers utilizing our internal network and third party databases. We leverage our relationships with strategic targets in the same industry that want to expand footprint, facilitate growth, or eliminate competition or financial targets which include private equity, investment management offices, family offices, and other investors primarily interested on earning a financial return on investment.

Negotiation and Closing

We are your advisor throughout the process, offering strategies for a successful negotiation and insights into common items such as: working capital target calculation, earnouts, rollover equity, and seller notes.